Receivable Protection Program

What is the RPP?

Three Essential Things to Know About the RPP

Compensation: Protection if a delinquent company goes out of business

- Invoices reported to IAM within 120 days of the invoice date may be eligible for RPP compensation, offering protection of up to $20,000 USD per creditor.

Formal Intervention: If unpaid invoices are not resolved in the IIRS, IAM can continue the intervention process for debts over $3,000 USD.

- Note: For ITMC creditors, there is no monetary threshold for formal intervention.

Enforcement: IAM can impose consequences if debts remain unresolved, including:

- Alleged Debtor List Publication: This list details IAM members who are allegedly delinquent on payments owed to other IAM members.

- Repeat Violators Publication: Any IAM member company that has been reported five or more times to the IAM Issue Resolution System by at least five distinct IAM member companies within a rolling three-month period.

- Expulsion: Any IAM member company may request the expulsion of another IAM member company for failure to settle debts if the amount due exceeds $10,000 USD.

How does it Work?

All unpaid invoices between IAM members should be reported through the IAM Issue Resolution System (IIRS). If requested, IAM will initiate the first stage of intervention. If the debt remains unresolved after this initial intervention, the RPP can offer further support through continued formal intervention and, if applicable, RPP compensation in cases where a delinquent member company files for bankruptcy or becomes non-operational.

Once the initial 30-day self-resolution period in the IIRS has expired and if the unpaid invoice(s) remain unresolved, IAM staff will guide you through the RPP process. Staff will assess whether the reported debt qualifies for Formal Intervention and evaluate which submitted invoices may be eligible for RPP Compensation should the delinquent company become non-operational. Please note that additional documentation may be requested to facilitate a smooth and efficient process.

What is RPP Formal Intervention?

IAM Members may request IAM Staff intervention on any invoice(s) greater than USD $3,000 owed by another IAM member following the unsuccessful conclusion of the IAM Issue Resolution System process.

In situations where an IAM Member is in debt to another Member who holds the IAM Trusted Moving Company (ITMC) designation, IAM Staff may intervene on behalf of the company who holds the ITMC designation if the debt is less than $3,000 USD.

However, only debts greater than USD $3,000 shall be posted to the Alleged Debtors List. By default, IAM treats each reported invoice in a confidential manner and will only initiate the intervention process if the filed by party has requested that IAM intervene.

What is RPP Compensation?

IAM will compensate members if they are owed money by another IAM member who has filed for bankruptcy or is no longer operating. To qualify, invoices must be reported to IAM within 120 days of the invoice date.

IAM reviews eligible unpaid invoices before the new fiscal year, and payments are made after January 1 of the following year.

The compensation process starts once IAM confirms that the delinquent company is financially insolvent, bankrupt, or no longer operating. Members must submit the required documents, as described in the RPP Operating Rules , for the review process to begin.

Compensation amounts are based on a maximum yearly limit, which depends on the total number of IAM members at the end of the fiscal year. These limits help keep the RPP Reserve Fund stable. More details about compensation limits are available in Section II.A of the RPP Operating Rules.

Please notify rpp@iamovers.org if you suspect that an IAM member has become non-operational or has filed for bankruptcy.

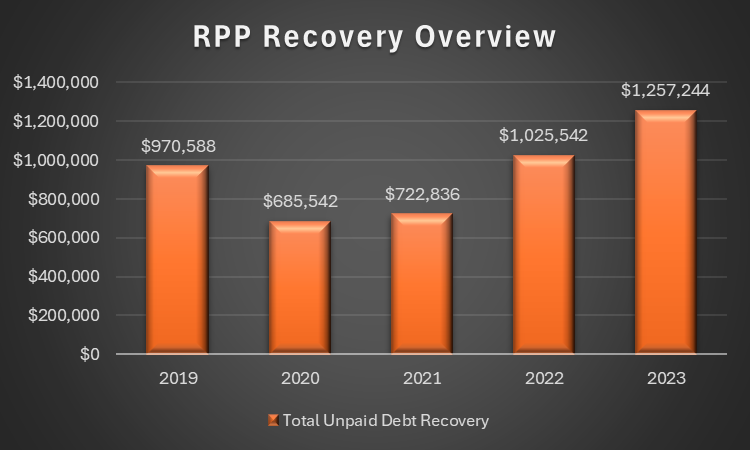

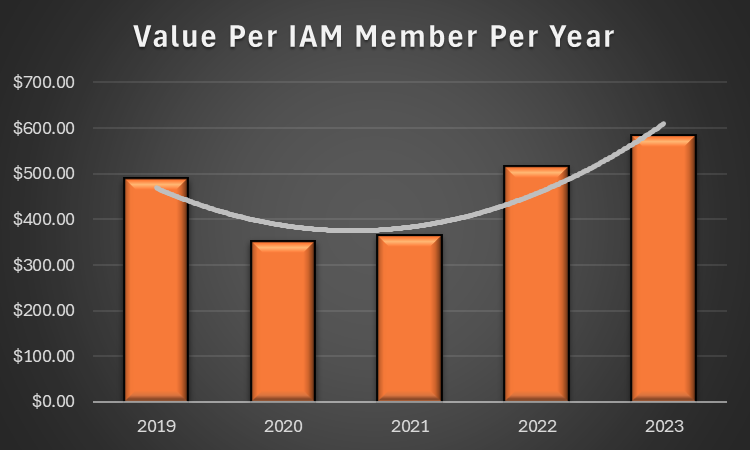

What is the Value of the RPP?